Difference Between Bookkeeping and Accounting: A Complete Guide

When it comes to managing business finances, many people confuse bookkeeping and accounting. While the two are closely related, they serve different purposes. Understanding the difference between bookkeeping and accounting is crucial for making informed financial decisions, especially for small businesses and startups in Australia.

What is Bookkeeping?

Bookkeeping is the process of recording day-to-day financial transactions. A bookkeeper ensures that every expense, income, invoice, and payment is accurately tracked and stored.

Key Tasks of a Bookkeeper:

Recording sales and purchases.

Managing invoices and receipts.

Reconciling bank statements.

Tracking expenses and cash flow.

Maintaining financial records.

👉 Simply put, bookkeeping is the foundation of your financial data.

What is Accounting?

Accounting goes beyond just recording data—it involves interpreting, analysing, and presenting that financial information to guide business decisions. Accountants use the data recorded by bookkeepers to prepare reports and provide insights.

Key Tasks of an Accountant:

Preparing financial statements.

Analysing financial performance.

Ensuring compliance with tax laws.

Preparing budgets and forecasts.

Advising on financial strategy.

👉 Accounting turns financial data into actionable business insights.

Key Difference Between Bookkeeping and Accounting

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Purpose | Recording daily financial transactions | Analysing, interpreting, and reporting financial data |

| Focus | Data entry and accuracy | Decision-making and strategy |

| Skills Required | Detail-oriented, basic financial knowledge | Analytical, strategic, compliance knowledge |

| Output | Ledgers, journals, records | Financial statements, tax returns, reports |

| Who Does It? | Bookkeeper | Accountant |

Do You Need Both Bookkeeping and Accounting?

Yes! Bookkeeping and accounting work hand in hand. Without bookkeeping, accounting has no reliable data. Without accounting, bookkeeping data cannot be turned into valuable insights.

For businesses in Australia, combining both ensures:

Accurate financial records.

Tax compliance.

Better cash flow management.

Informed strategic planning.

Which One is Right for Your Business?

Startups & Small Businesses: Begin with bookkeeping to track cash flow.

Growing Companies: Use accounting for deeper insights, compliance, and financial planning.

All Businesses: Ideally, invest in both bookkeeping and accounting for complete financial health.

Final Thoughts

The difference between bookkeeping and accounting lies in their purpose—bookkeeping records the financial story, while accounting interprets it. For sustainable growth, businesses in Australia need both functions working together.

At Vital Corporate Solutions, we provide bookkeeping and accounting services tailored to Australian businesses. Whether you’re a startup or an established company, our experts can help you stay compliant, reduce costs, and make smarter financial decisions.

👉 Get Professional Bookkeeping & Accounting Services in Australia

- If you’re comparing bookkeeping and accounting from a compliance perspective, the Australian Securities & Investments Commission (ASIC) outlines the responsibilities businesses must meet under Australian law.

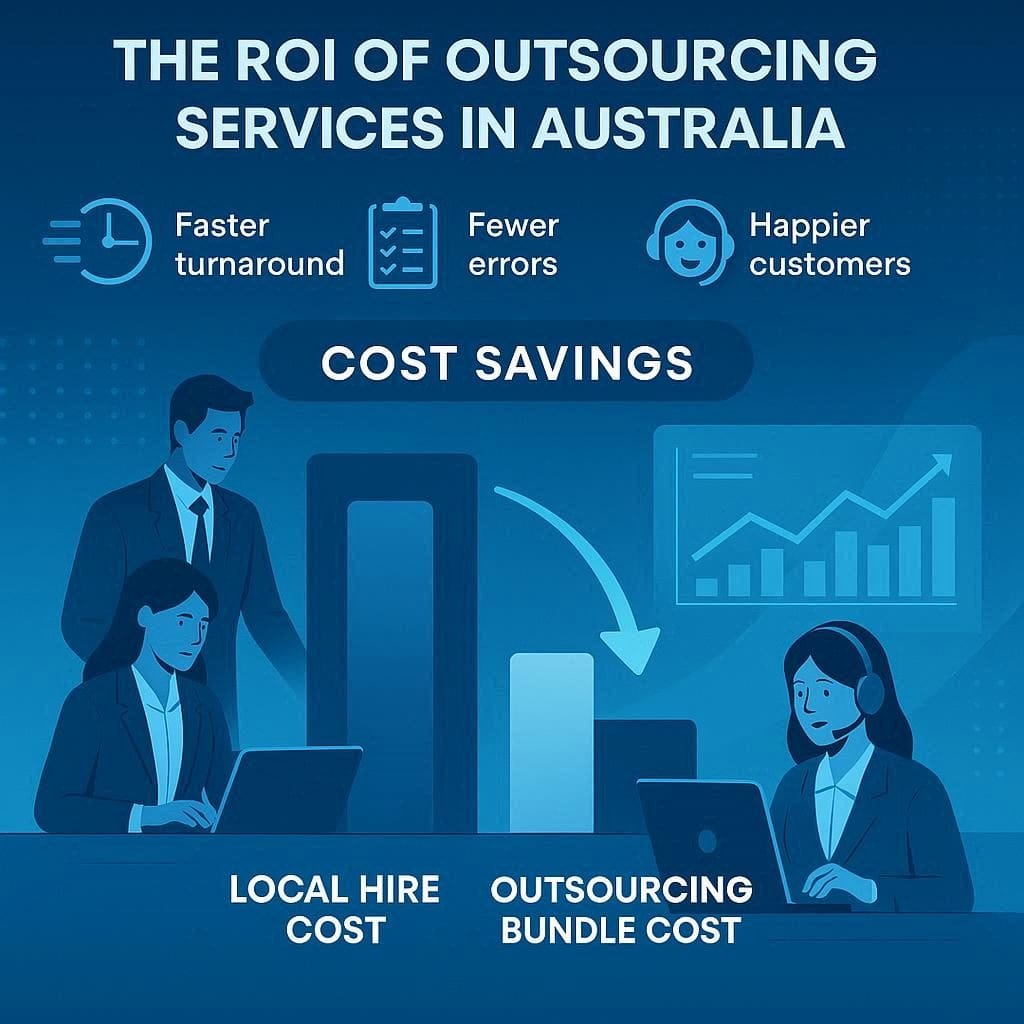

Try Vital CS Outsourcing With Zero Risk

Ready to test outsourcing services in Australia without risk? Message Vital CS with your top backlog pain point, target SLA, and preferred hours. We’ll propose a 2–4 week pilot, show the numbers, and scale only when you’re happy.