Outsourcing Accounting Services: A Complete Guide for Australian Businesses

In today’s competitive market, businesses across Australia are increasingly turning to outsourcing accounting services as a smarter, more cost-effective way to manage their finances. From startups to established enterprises, outsourcing allows companies to access expert financial support without the overheads of maintaining an in-house team.

What Are Outsourced Accounting Services?

Outsourced accounting services refer to delegating all or part of your financial management—such as bookkeeping, payroll, tax filing, and reporting—to an external professional or firm. Instead of hiring a full-time accountant, businesses gain access to specialists who use advanced tools and knowledge to ensure accuracy, compliance, and efficiency.

This approach not only reduces costs but also provides businesses with flexibility to scale services as they grow.

Benefits of Outsourcing Accounting Services

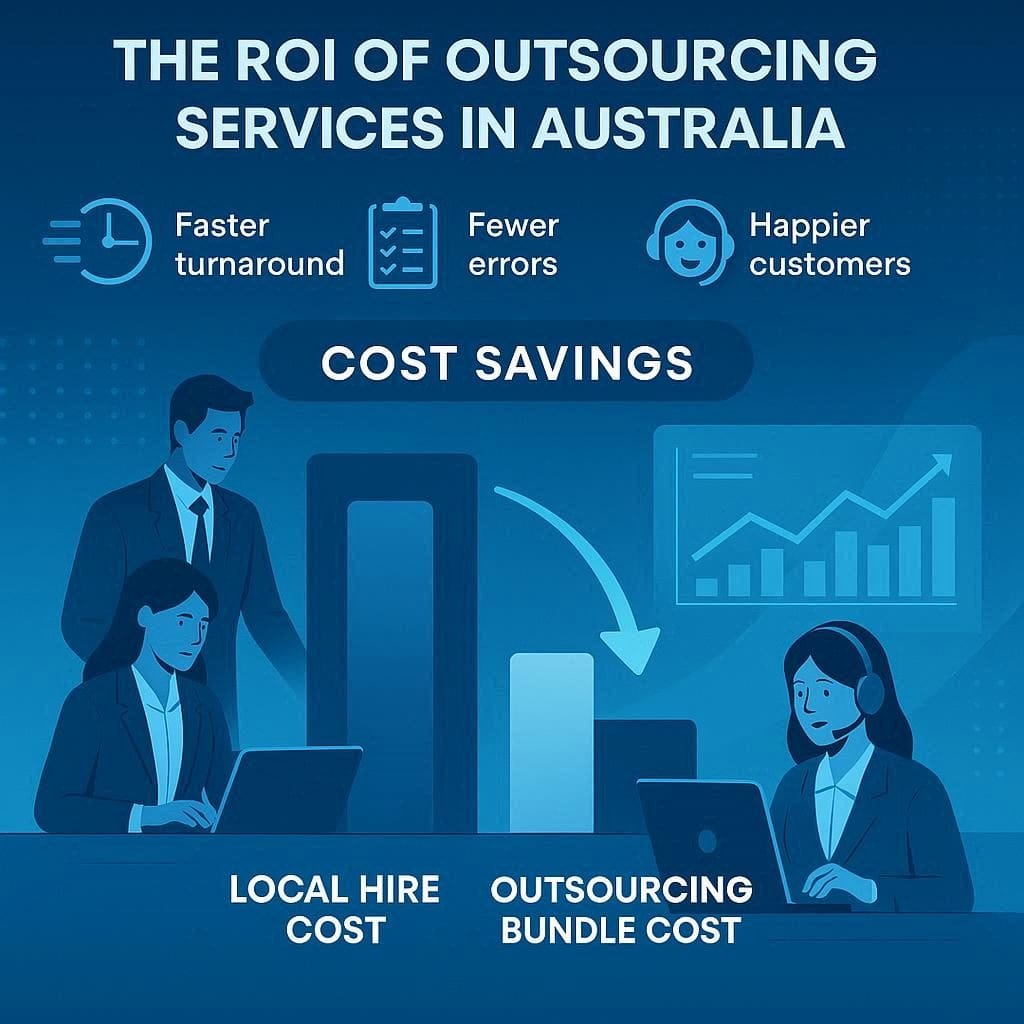

Cost Savings for Small & Medium Businesses

Hiring full-time accountants can be expensive, especially when salaries, superannuation, and training costs are factored in. Outsourcing lets businesses pay only for the services they need.

Access to Expertise Without Full-Time Costs

Outsourcing connects businesses with qualified professionals experienced in Australian tax laws, BAS lodgement, and modern accounting systems like Xero and MYOB.

Scalability and Flexibility

As your business grows, outsourced providers can easily expand their services—whether it’s handling additional payrolls or providing more complex financial reports.

Compliance with Australian Tax Laws

Staying compliant with ATO requirements is critical. Outsourced accountants are up-to-date with tax regulations, reducing the risk of penalties and errors.

Outsourced Accounting vs. In-House Accounting

Efficiency and Productivity

Outsourcing saves time for business owners, allowing them to focus on core growth activities instead of financial admin.

Technology & Tools Used in Outsourced Services

Providers often use cloud platforms like Xero, QuickBooks, and MYOB, offering real-time access to financial data and seamless collaboration.

Risk Management

External experts can identify risks early, helping businesses avoid financial mistakes or compliance issues.

According to CPA Australia, many businesses outsource accounting to cut costs while maintaining compliance.

Key Services Covered in Outsourced Accounting

Bookkeeping & Payroll Processing – Managing day-to-day records and employee payments.

Tax Filing & BAS Lodgement – Ensuring timely compliance with the ATO.

Financial Reporting & Forecasting – Providing insights for better decision-making.

Cloud Accounting Solutions – Secure, accessible, and streamlined financial data management.

Who Should Consider Outsourcing Accounting Services?

Data Security Concerns → Partner with firms that use encrypted, cloud-based accounting systems.

Choosing the Right Provider → Look for providers with Australian compliance knowledge and industry experience.

Maintaining Communication → Ensure regular reporting and check-ins.

Why Australian Businesses Trust Outsourcing

The Australian business landscape is becoming more competitive, and outsourcing provides a strategic advantage. By cutting overhead costs and gaining access to skilled professionals, businesses stay lean while still meeting high financial standards.

Wrapping Up: Is Outsourcing Accounting Right for You?

Outsourcing accounting services offers cost savings, compliance assurance, and professional expertise—making it the go-to solution for Australian businesses aiming to simplify finances and drive growth.

👉 Ready to streamline your financial operations? Explore our Outsourced Bookkeeping & Accounting Services in Australia today.

Try Vital CS Outsourcing With Zero Risk

Ready to test outsourcing services in Australia without risk? Message Vital CS with your top backlog pain point, target SLA, and preferred hours. We’ll propose a 2–4 week pilot, show the numbers, and scale only when you’re happy.