Top Accounting Firms in Australia: Big 4, Mid-Tier Players & Outsourcing Trends

Running a business in Australia means staying on top of accounting, tax, and compliance requirements. But with so many firms offering financial services — from the Big 4 giants to boutique specialists — how do you decide which one is best for you? This guide explores the top 10 accounting firms in Australia, their services, and why outsourcing is emerging as a powerful alternative for small and mid-sized businesses.

Australia’s Leading Accounting Firms at a Glance

Accounting firms in Australia range from global networks with thousands of employees to specialist mid-tier firms that serve niche industries. What they all share is the ability to help businesses manage finances, meet tax obligations, and provide strategic advice.

What Defines a “Top” Accounting Firm in Australia?

Not every accounting firm makes it to the top tier. A leading firm typically stands out due to:

Breadth of services (tax, audit, advisory, consulting).

Industry reputation and client trust.

Innovation in technology and cloud-based accounting.

Scalability — serving startups, SMEs, and multinationals.

Global presence (for Big 4 firms).

For small and medium enterprises, however, “top” doesn’t always mean the biggest — value for money and personalized service matter just as much.

The Big Names & Beyond: Australia’s 10 Leading Accounting Firms

Here are the accounting firms that dominate the Australian market today:

PwC Australia

Known for its global reach, PwC offers auditing, consulting, and tax services. It’s the go-to for large corporations seeking end-to-end financial management.

Aone Outsourcing

A rising star in the outsourcing space, Aone Outsourcing provides cost-effective accounting and bookkeeping services to SMEs, bridging the gap between quality and affordability.

KPMG

KPMG’s strength lies in audit and advisory services, particularly for enterprises navigating complex financial compliance requirements.

Findex

With regional offices across Australia, Findex is known for supporting small businesses and rural enterprises with accounting and financial advice.

McGrathNicol

Specializing in restructuring, insolvency, and risk management, McGrathNicol is often sought after in complex financial situations.

Deloitte Australia

Deloitte combines technology with financial expertise, making it popular among companies that want digital solutions alongside traditional accounting.

Ernst & Young (EY)

EY is recognized for innovation and industry-specific solutions. It serves businesses ranging from startups to Fortune 500 companies in Australia.

Pitcher Partners

Focused on mid-market businesses, Pitcher Partners is trusted for tax, audit, and wealth management services.

BDO

A strong mid-tier firm with a personal approach. BDO is well-respected among SMEs and family-owned businesses.

Grant Thornton

Grant Thornton delivers a balance of global resources and local expertise, particularly valuable for businesses in growth phases.

Services You Can Expect from Australia’s Top Accounting Firms

Core Accounting & Compliance

Tax preparation and lodgement

Audit and assurance services

Payroll management

Bookkeeping and compliance reporting

Extended Consulting & Advisory

Business restructuring and insolvency solutions

Risk management and compliance strategies

Financial planning and wealth management

Digital transformation for finance functions

How to Select the Right Accounting Partner for Your Business

Choosing the best firm depends on your goals:

Startups: Look for cost-effective packages with bookkeeping, payroll, and BAS services.

SMEs: Mid-tier firms often provide the right balance between expertise and affordability.

Enterprises: Big 4 firms offer global expertise and scalability.

Cost-conscious businesses: Outsourcing firms provide expert services at a fraction of Big 4 costs.

Big 4 vs. Mid-Tier: Which is Better for SMEs in Australia?

Big 4 Advantages: Global resources, advanced technology, industry expertise.

Big 4 Limitations: Higher fees, less personalized service.

Mid-Tier Advantages: Affordable pricing, tailored advice, and stronger client relationships.

Mid-Tier Limitations: Limited global reach compared to Big 4.

For SMEs, mid-tier and outsourcing solutions often deliver better value than the traditional Big 4 approach.

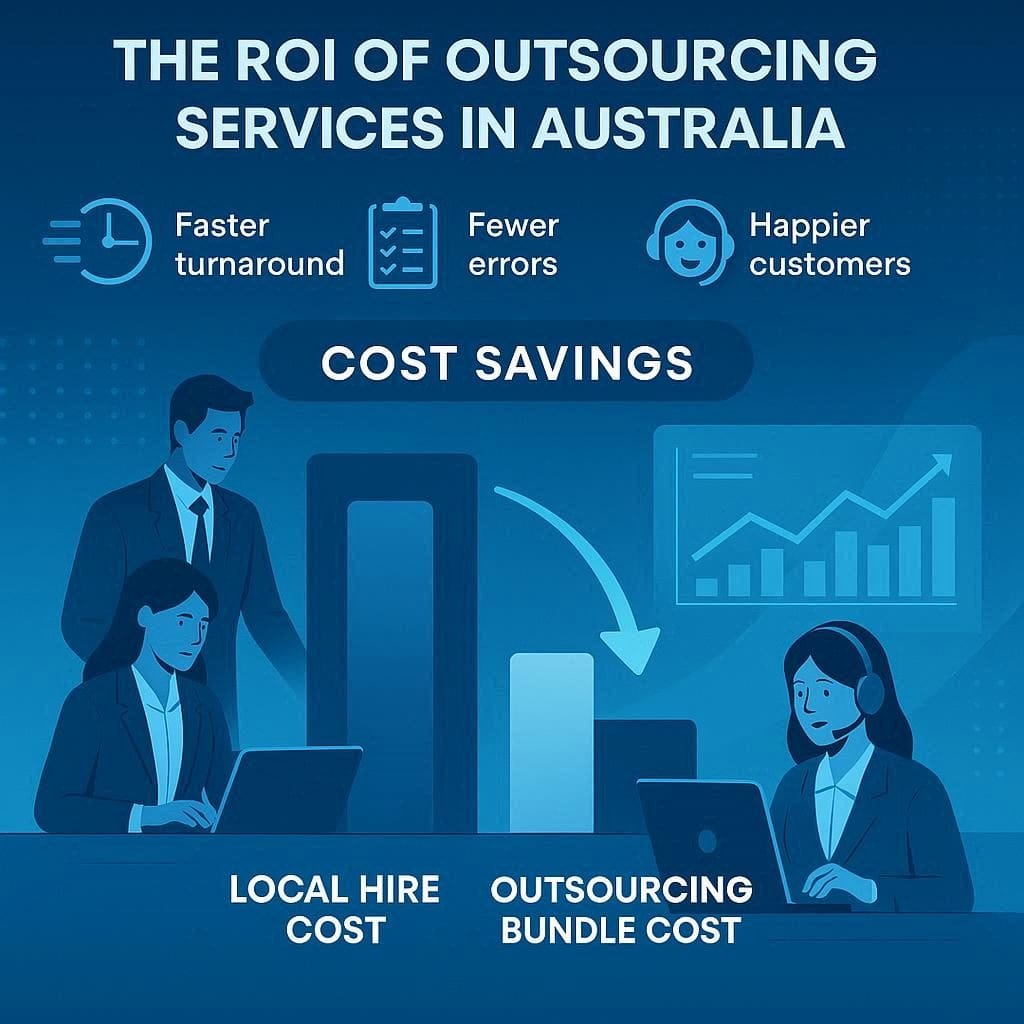

Outsourcing Accounting: A Rising Alternative for Businesses

The outsourcing trend is reshaping the accounting industry in Australia.

Why More Companies Are Choosing Outsourcing

Significant cost savings (up to 60%).

Access to skilled professionals without hiring in-house.

Flexibility to scale services as needed.

Improved efficiency through cloud-based tools.

Benefits Outsourcing Brings to CPA & Accounting Firms

Handle more clients without expanding headcount.

Reduce operational costs.

Free up resources for higher-value advisory services.

What Lies Ahead for Australia’s Accounting Industry?

- The future is a blend of automation, cloud accounting, and outsourcing partnerships. While the Big 4 will continue to dominate, mid-tier firms and outsourcing providers are expected to see rapid growth as SMEs seek more affordable yet high-quality services.

Conclusion: Beyond the Big 4 – The Growth of Outsourced Accounting

- Australia’s accounting landscape is evolving. While the Big 4 remain powerhouses, mid-tier firms and outsourcing providers are becoming the go-to choice for small businesses and cost-conscious companies. For many, outsourcing represents not just a cost-saving measure but a smarter, future-ready way of handling finances.

FAQs on Accounting Firms in Australia

Mid-tier firms like Findex, BDO, and Pitcher Partners are ideal for SMEs. Outsourcing providers like Aone Outsourcing also serve small businesses effectively.

Yes — they usually offer more personalized service at lower costs, making them attractive to SMEs.

Assess your budget, industry needs, and whether you require global expertise or local hands-on support.

Tax planning, risk management, restructuring, financial advisory, and digital transformation services.

Try Vital CS Outsourcing With Zero Risk

Ready to test outsourcing services in Australia without risk? Message Vital CS with your top backlog pain point, target SLA, and preferred hours. We’ll propose a 2–4 week pilot, show the numbers, and scale only when you’re happy.